The Adani group is reportedly in talks with foreign lenders to refinance debt taken for the acquisition of Holcim’s cement business in India last year.

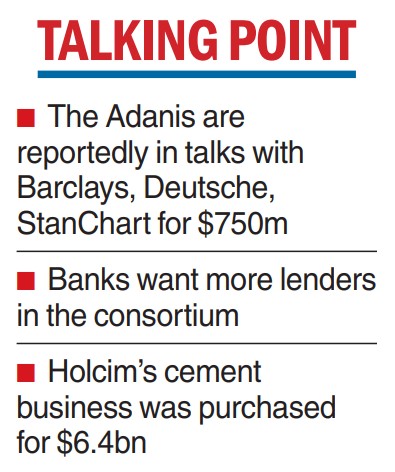

A Bloomberg report said the conglomerate is in talks with Barclays, Deutsche Bank AG and Standard Chartered to jointly borrow $ 600-750 million.

In a late evening announcement, Adani Enterprises said Adani New Industries, an arm of the company, on Thursday raised $394 million (Rs 3,231 crore) from Barclays plc and Deutsche Bank AG.

The proceeds will be used to secure working capital requirements of an integrated solar module manufacturing facility, Adani Enterprises said.

In September last year, the Adani group completed the purchase of Holcim’s business in India including Ambuja Cements and ACC — for a cash consideration of $6.4 billion.

The deal had included Holcim’s 63.11 per cent stake in Ambuja Cements, which owned 50.05 per cent interest in ACC, and Holcim’s 4.48 per cent direct stake in ACC. The conglomerate had taken a loan of $3.8 billion to finance the acquisition.

Apart from the three foreign lenders, the group is looking to bring more banks into the consortium to refinance the loan facility.

Earlier, reports had said that while Barclays, Deutsche Bank and Standard Chartered were willing to refinance the loan, they wanted more banks to come in.

In January, the Adani group was hit by a damaging report from Hindenburg. The short-seller had alleged accounting fraud and stock price manipulation, which were denied by the conglomerate.

While there were concerns about the heavy debt levels in the group, the group hasengaged in a deleveragingexercise since March by bringing down share-backed debt.

Three of its group firms are now planning to raiseover Rs 33,000 crore part of which may also be used to trim debt.

Recently, the promoters had raised $1.38 billion (Rs 11,330 crore) through a stake sale in three group companies to US-based global equity investment boutique GQG Partners in two tranches.

This was preceded by a stake sale from the family in March aggregating $1.87 billion (Rs 15,446 crore). Consequently, the group said that it fully paid margin-linked, share-backed financing.

Meanwhile, Adani Transmission Ltd on Thursday said it has renamed itself to Adani Energy Solutions Limited with immediate effect.