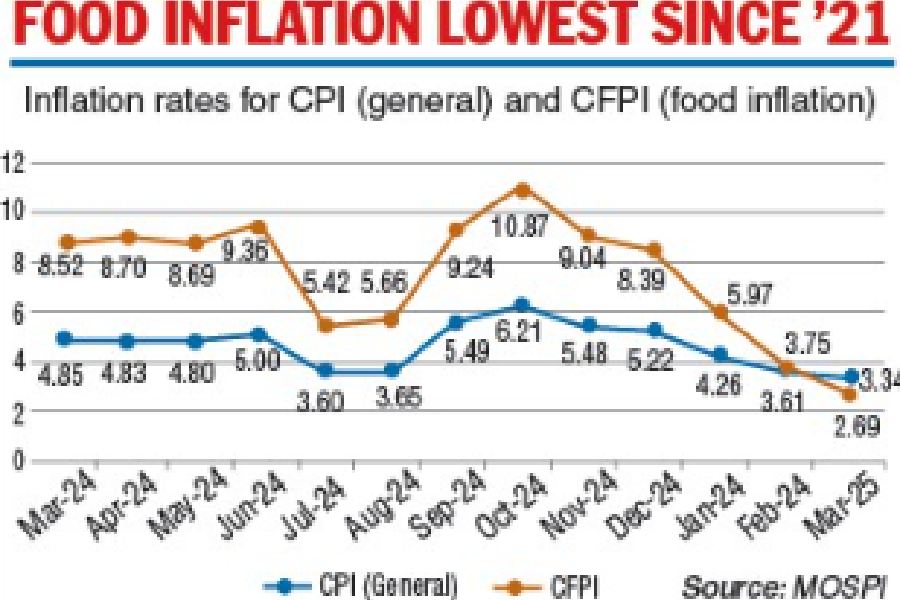

Retail inflation touched a near six-year low of 3.34 per cent in March, fuelled by falling vegetable prices. The easing of Consumer Price Index (CPI) inflation has given the requisite room for a consumption boost, which is expected to aid the country’s economic growth.

CPI inflation was 3.61 per cent in February and 4.85 per cent in March last year. During March, a sharp decline of 106 basis points was observed in food inflation compared with February 2025. Food inflation in March 2025 is the lowest after November 2021.

“The significant decline in headline inflation and food inflation during March 2025 is mainly attributed to the decline in inflation of vegetables, eggs, pulses and products, meat and fish, cereals and products and milk and products,” a statement from the Union ministry of statistics and programme implementation (MOSPI) said.

The key items having the lowest year-on-year inflation in March were ginger (-38.11 per cent), tomato (-34.96 per cent), cauliflower (-25.99 per cent), jeera (-25.86 per cent) and garlic (-25.22 per cent).

However, the items showing the highest year-on-year inflation in March were coconut oil (56.81 per cent), coconut (42.05 per cent), gold (34.09 per cent), silver (31.57 per cent) and grapes (25.55 per cent).

Kerala was the state with the highest CPI inflation in March at 6.59 per cent, ahead of Karnataka, Chhattisgarh and Maharashtra. Bengal’s CPI inflation in March was at 3.17 per cent.

Room for repo cut

The March inflation numbers were below the RBI’s 4 per cent inflation target, leaving room for further easing of the policy rates in the subsequent monetary policy meetings. Since February the RBI has cut the benchmark repo rate by 50 basis points to 6 per cent.

Economists and investment banks such as Morgan Stanley and Nomura expect the repo rate to go as low as 5 per cent in the current easing cycle, drawing comfort from benign inflation rates.

“The Indian Meteorological Department’s forecast of an above-normal monsoon for 2025 and Skymet’s forecast of a normal one add to the happy tidings on the food inflation front. On the other hand, a sharper-than-expected fall in crude oil prices will help keep non-food inflation comfortable as well,” said Dharmakirti Joshi, chief economist, Crisil Limited.

“For fiscal 2026, we expect headline inflation at 4.3 per cent with food, fuel and core readings at 4.6 per cent, 2.5 per cent, 4.2 per cent, respectively. For this fiscal, we have also pencilled in two more repo rate cuts of 25 bps each by the MPC,” Joshi said.

A similar opinion was echoed by Upasna Bhardwaj, chief economist, Kotak Mahindra Bank, who said that RBI will continue on its accommodative stance with the terminal repo rate likely around 5-5.25 per cent.

The Reserve Bank has projected CPI inflation for the current fiscal year 2025-26 at 4 per cent, with Q1 at 3.6 per cent, Q2 at 3.9 per cent, Q3 at 3.8 per cent, and Q4 at 4.4 per cent. The risks are evenly balanced.

WPI falls

Wholesale price inflation declined to a 6-month low of 2.05 per cent in March as prices of vegetables, potatoes and other food items eased, government data showed on Tuesday.

Wholesale price index (WPI) based inflation was 2.38 per cent in February. It was 0.26 per cent in March last year. While inflation in primary articles moderated significantly, primarily due to a decline in food prices, this was offset by a rise in inflation within manufactured goods,

“Going ahead, it is crucial to monitor geopolitical developments and global trade uncertainties closely, as these could significantly influence global commodity markets and supply chains.

“Recent depreciation of the rupee against the US dollar raises the risk of imported inflation,” said Rajani Sinha, chief economist, CareEdge Ratings

“For FY26, the WPI inflation is projected to average around 3 per cent,” Sinha said.